The Legal Framework Behind Offshore Trusts You Can’t Ignore

Why You Need To Consider an Offshore Depend On for Safeguarding Your Properties and Future Generations

If you're looking to safeguard your riches and guarantee it lasts for future generations, taking into consideration an offshore depend on might be a wise step. As you check out the possibility of offshore depends on, you'll uncover exactly how they can be tailored to fit your particular demands and goals.

Comprehending Offshore Trust Funds: What They Are and Exactly How They Function

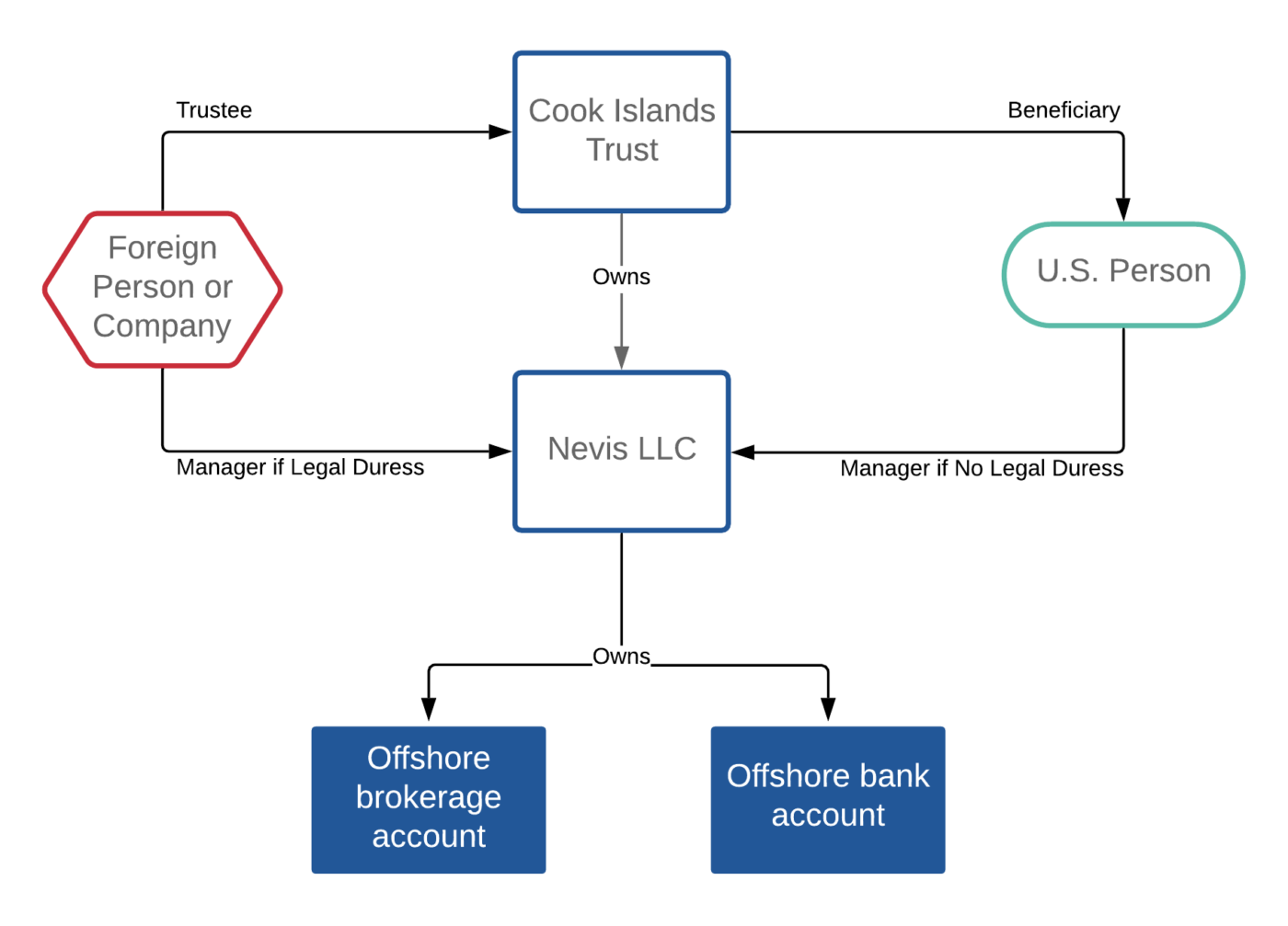

When you assume concerning guarding your properties, offshore trust funds might come to mind as a viable alternative. An overseas depend on is a legal plan where you move your assets to a trustee situated in an additional country.

The key components of an overseas depend on include the settlor (you), the trustee, and the recipients. Comprehending just how overseas depends on function is essential before you determine whether they're the ideal option for your property security approach.

Benefits of Developing an Offshore Trust

Why should you think about developing an offshore trust fund? One of the main benefits is tax obligation efficiency. By positioning your assets in a jurisdiction with favorable tax obligation legislations, you can potentially decrease your tax obligation burden while guaranteeing your wealth expands. Additionally, offshore depends on offer versatility concerning property monitoring. You can tailor the depend on to fulfill your specific requirements, whether that's keeping control over your assets or ensuring they're dispersed according to your wishes.

Offshore trust funds can provide a higher degree of discretion, shielding your monetary affairs from public scrutiny. Developing an overseas trust fund can advertise generational wealth preservation. Eventually, an offshore depend on can offer as a tactical tool for protecting your monetary legacy.

Shielding Your Assets From Lawful Claims and Lenders

Developing an overseas trust not only provides tax obligation advantages and privacy yet likewise acts as a powerful shield against lawful insurance claims and creditors. When you put your assets in an overseas depend on, they're no much longer thought about part of your individual estate, making it much harder for financial institutions to access them. This separation can protect your wide range from claims and claims emerging from service disputes or individual liabilities.

With the right territory, your possessions can gain from rigid privacy laws that hinder lenders from seeking your wealth. In addition, several offshore counts on are developed to be testing to penetrate, often needing court activity in the count on's territory, which can act as a deterrent.

Tax Obligation Efficiency: Lessening Tax Obligations With Offshore Trusts

In addition, because counts on are usually taxed differently than individuals, you can take advantage of reduced tax obligation prices. It's essential, nonetheless, to structure your trust properly to guarantee compliance with both residential and worldwide tax legislations. Dealing with a certified tax advisor can help you navigate these intricacies.

Ensuring Privacy and Confidentiality for Your Wide Range

When it involves shielding your riches, ensuring privacy and privacy is vital in today's significantly clear economic landscape. An overseas trust fund can provide a layer of security that's hard to accomplish via residential options. By positioning your properties in an overseas territory, you shield your monetary details from public scrutiny and lower the danger of unwanted interest.

These trusts often include strict personal privacy laws that protect against unauthorized accessibility to your monetary details. This indicates you can protect your wide range while preserving your peace of mind. You'll additionally restrict the possibility of lawful conflicts, as the details of your trust fund stay confidential.

Furthermore, having an overseas depend on indicates your assets are less susceptible to personal responsibility cases or unexpected economic situations. It's a proactive step you can take to ensure your monetary heritage continues to be intact and personal for future generations. Count on an overseas structure to guard your wealth efficiently.

Control Over Property Circulation and Management

Control over possession circulation and administration is just one of the vital benefits of establishing an overseas trust. By establishing this trust, you can dictate exactly how and when your properties are dispersed to recipients. You're webpage not simply handing over your wealth; you're setting terms that show your vision for your tradition.

You can develop details problems for distributions, ensuring that recipients fulfill particular requirements before getting their share. This control aids prevent mismanagement and assurances your assets are made use of in methods you regard proper.

Furthermore, assigning a trustee permits you to entrust monitoring obligations while preserving oversight. You can select a person that straightens with your worths and comprehends your objectives, assuring your possessions are handled carefully.

With an offshore trust, you're not just guarding your riches however also shaping the future of your recipients, giving them with the assistance they need while maintaining your desired degree of control.

Selecting the Right Territory for Your Offshore Count On

Search for countries with solid lawful structures that sustain depend on legislations, ensuring that your properties continue to be secure from potential future claims. Additionally, ease of access to neighborhood financial organizations and seasoned trustees can make a big distinction in handling your trust successfully.

It's vital to evaluate the expenses entailed as well; some territories might have greater setup or upkeep fees. Eventually, picking the right territory suggests aligning your financial goals and family members needs with the particular advantages provided by that place - Offshore Trusts. Take your time to research and seek advice from experts to make the most educated decision

Frequently Asked Questions

What Are the Expenses Connected With Establishing an Offshore Depend On?

Setting you can find out more up an offshore trust involves various prices, consisting of lawful costs, setup costs, and recurring upkeep expenditures. You'll intend to spending plan for these aspects to assure your trust fund runs successfully and effectively.

Just How Can I Locate a Respectable Offshore Trust Fund Provider?

To locate a reputable offshore trust provider, research online evaluations, request recommendations, and validate credentials. Make certain they're experienced and clear about charges, services, and regulations. Depend on your instincts during the option process.

Can I Handle My Offshore Count On Remotely?

Yes, you can manage your overseas trust remotely. Lots of suppliers offer on the internet accessibility, allowing you to monitor investments, communicate with trustees, and gain access to files from anywhere. Simply ensure you have safe and secure net access to shield your details.

What Occurs if I Move to a Various Nation?

If you relocate to a various country, your offshore trust fund's policies could change. You'll require to speak with your trustee and possibly straight from the source adjust your trust fund's terms to follow local legislations and tax ramifications.

Are Offshore Trusts Legal for People of All Countries?

Yes, overseas counts on are legal for people of many nations, however laws vary. It's necessary to investigate your nation's legislations and get in touch with a legal specialist to ensure compliance and comprehend potential tax obligation ramifications before continuing.